Tesla Salary Sacrifice

The Tesla approach has made many manufacturers stand up and listen to the changes afoot. You save most of the VAT 32 42 tax savings and National Insurance savings on the car payments with other savings too.

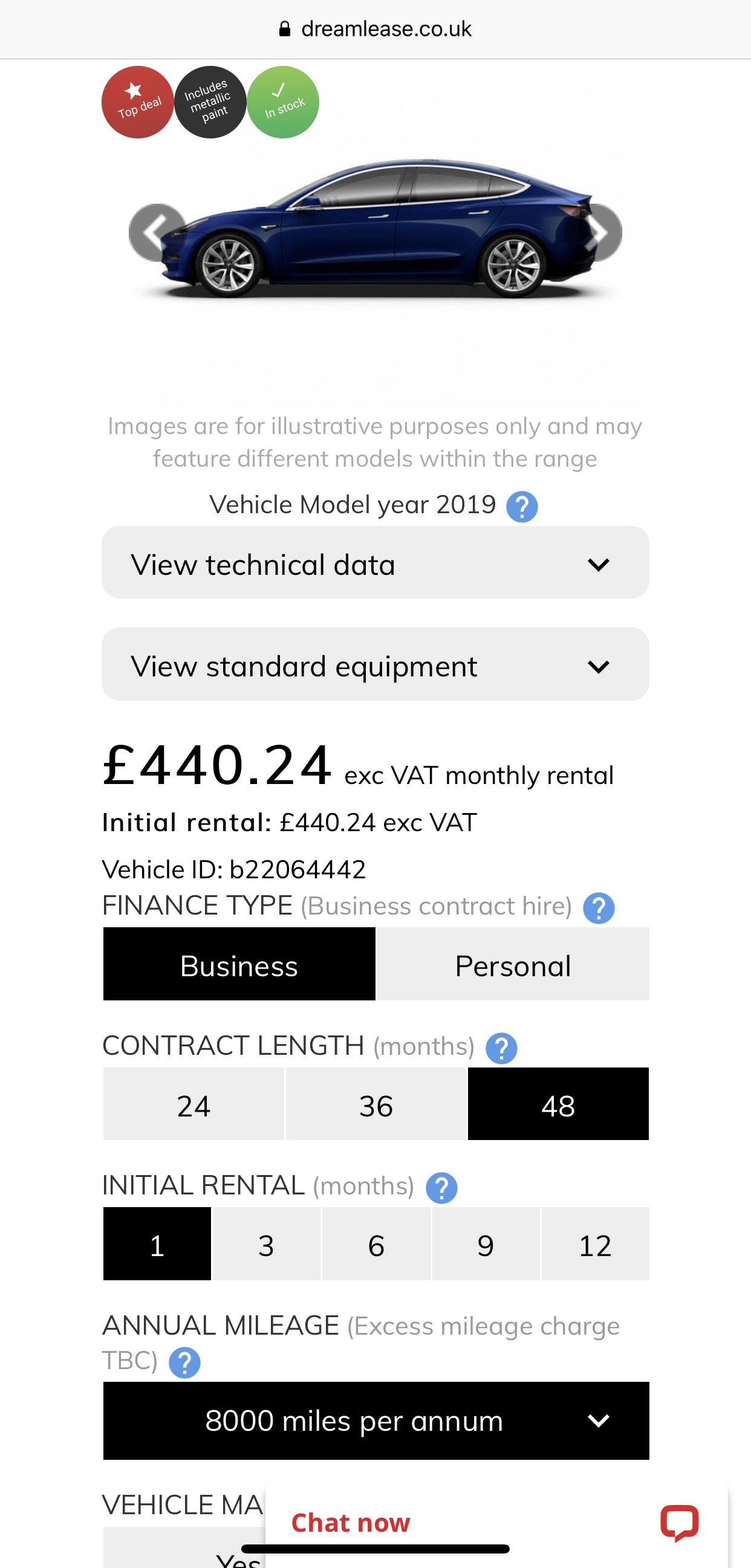

Business Lease Tesla Model 3 Leaseplan

On the technical-side company car and salary sacrifice users can note the P11d at 50935 and CO2 at 0gkm.

Tesla salary sacrifice. And provides a breakdown of your annual salary with Monthly Quarterly Weekly Daily and Hourly pay illustrations. The monthly cost for a Tesla Model 3 Standard Range Plus with no deposit down over 48 months could be roughly 530 but under salary sacrifice for a higher rate taxpayer it effectively costs 42 per cent less or 307 of the wages they would normally see per month. Vehicle tax rates Budget 2020.

The 78kWh lithium-ion battery delivers 351ps 0-62 times of 42 seconds and service intervals of 24 months25000 miles. Weve got a dedicated team who can talk you through it calculate your bespoke savings and even get it set up within your business. The Tesla Model 3 is available from 400month on salary sacrifice.

The monthly cost for a Tesla Model 3 Standard Range Plus with no deposit down over 48 months could be roughly 530 but under salary sacrifice for a. We simply bill them for the car and they deduct the cost from your GROSS salary pre-tax. We are the Salary Sacrifice experts.

Jul 17 2019. This includes an exemption from the luxury car surcharge from 1 April 2020 until 31 March 2025. You do need to persuade your employer to offer it but it costs them nothing.

36 month 10000 mile per annum deal with insurancemaintenence included. I have come to the conclusion that the cheapest way into a Tesla 3 LR will be through a salary sacrifice scheme starting in the next year when BIK will be zero for ultra low emission cars. In total they sacrifice 835 each month from gross salary which equates to 498 per month net from their take home pay.

NET 40 28752. All Tesla cars have zero emissions and may be eligible for financial incentives that encourage clean energy use in the UK including lower Benefit in Kind compared to petrol or diesel cars and salary sacrifice schemes. 545 per month once BIK tax reduces in April.

With zero emissions all Tesla cars are exempt from Vehicle Excise Duty. Significant take-up came as a result of popular launches. The salary sacrifice adjusted gross pay then provides a full tax calculation and includes personal tax allowances calculates your National Insurance Contributions and Your employers National Insurance Contributions deductions PAYE etc.

Speak to our Business Team. Tesla seems to be suggesting here that I can buy a car through my pre-tax earnings via a salary sacrifice scheme. So now the real challenge convincing my.

Basically meaning the cost is reduced significantly. We always handle all promotion and roll out for our customers. Salary Sacrifice is either offered by the employer or the leasing provider.

As the lease is taken before tax it will be significantly cheaper than any other way of getting one. While not yet wholly affordable to all the Model 3 is a great step towards achieving this. Salary Sacrifice lowers the cost of any car.

We can set up a salary sacrifice scheme in your business to help your employees save on average between 30-40 on their electric car lease through their salary. So give us a call on 020 8012 8190 or drop us a note and lets get cracking. With more quote activity as cars are delivered it shows no signs of dwindling.

The prices above are for some of the newest and best electric models on the market. If they arent enough to convince you that salary sacrifice is the way to go keep reading. If the car is an ultra-low emission vehicle Estimated Reading Time.

For example for a 40 per cent tax rate payer opting for a Tesla Model 3 the typical net cost for an employee is 435 every month with the gross sacrifice from salary coming in at 726 per month. And for a basic rate taxpayer it effectively costs 32 per cent less or 360 of the. The monthly benefit-in kind on this vehicle over 3 years is 0 14 and 29.

I took delivery of a salary sacrifice M3P from tusker last month. Not only will you be paying 0 BIK benefit in kind until April 2021 youll only pay 1 until April 2022. PLEASE USE THIS REFERRAL CODE FOR A 50 CREDIT WITH OCTOPUS ENERGYshareoctopusenergyglass-fern-251As always please feel free to drop me a line at ca.

For the range of a Tesla Model 3. Employee A is a 40 taxpayer and wants to lease a Tesla 3 over three years from her companies salary sacrifice scheme. With a standard plus long range and performance option there is effectively an answer to most of the company car salary sacrifice and personal leasing market.

NET 20 33710.

Business Lease Tesla Model S Leaseplan

Tesla Model S Long Range Plus Leases Wevee

Tesla Model 3 Contract Hire Through Salary Sacrifice 307 Per Month Hotukdeals

Private Lease Tesla Model 3 Leaseplan

Tesla Model 3 Performance Leases Wevee

Will Tesla Cars Take Over The World In Another 10 Years Quora

Tesla Model X Rivervale Leasing

Hmrc Clarifies Salary Sacrifice Car Scheme Tax

Tesla Model 3 Salary Sacrifice Youtube

Electric Car Salary Sacrifice Wevee

Tesla Model 3 Review 2021 Select Car Leasing

Tesla Model 3 Excluded As Electric Car Grant To Be Cut To 2 500 With Experts Branding Move As Too Soon Car Dealer Magazine

Private Lease Tesla Model 3 Leaseplan

Tesla With No Driver In Fatal Us Crash 2 Killed Report Hamara Jammu

Tesla And The Unavoidable Art Of Sacrifice

Post a Comment for "Tesla Salary Sacrifice"