Company Car Salary Sacrifice

Tax rules for car salary sacrifice schemes. We include insurance and accident management servicing maintenance and repair road-side assistance and recovery - as well as risk mitigations for early termination and end.

Salary Sacrifice Car Scheme Bluedrop

A Salary Sacrifice Car Scheme for Everyone.

Company car salary sacrifice. The cost of leasing the car is taken from the employees gross salary before tax therefore saving the employee their marginal tax rate off of the cost of the lease. The driver will be taxed on whichever is the higher amount of the car benefit or the sacrificed remuneration. The employee finances the car through payroll deductions and take advantage of the employers right to deduct VAT and reduced social security contributions.

If an employee enters into a company car arrangement after 5th April 2017 where the cars CO 2 emissions are over 75gkm and some form of remuneration is foregone enter the annual amount of the salary sacrifice or the car allowance. A salary sacrifice car is a car you lease from a third-party supplier that has partnered with your employer. Previously in 2017 the HMRC clarified that the changes to the tax treatment on salary sacrifice vehicles only.

A client wants to provide a car or an employee has requested it via an Optional Remuneration Arrangement salary sacrifice. The monthly cost on lease is 840 including VAT. Essentially the same as what youd pay anyway but with a new clean car for a cheaper cost.

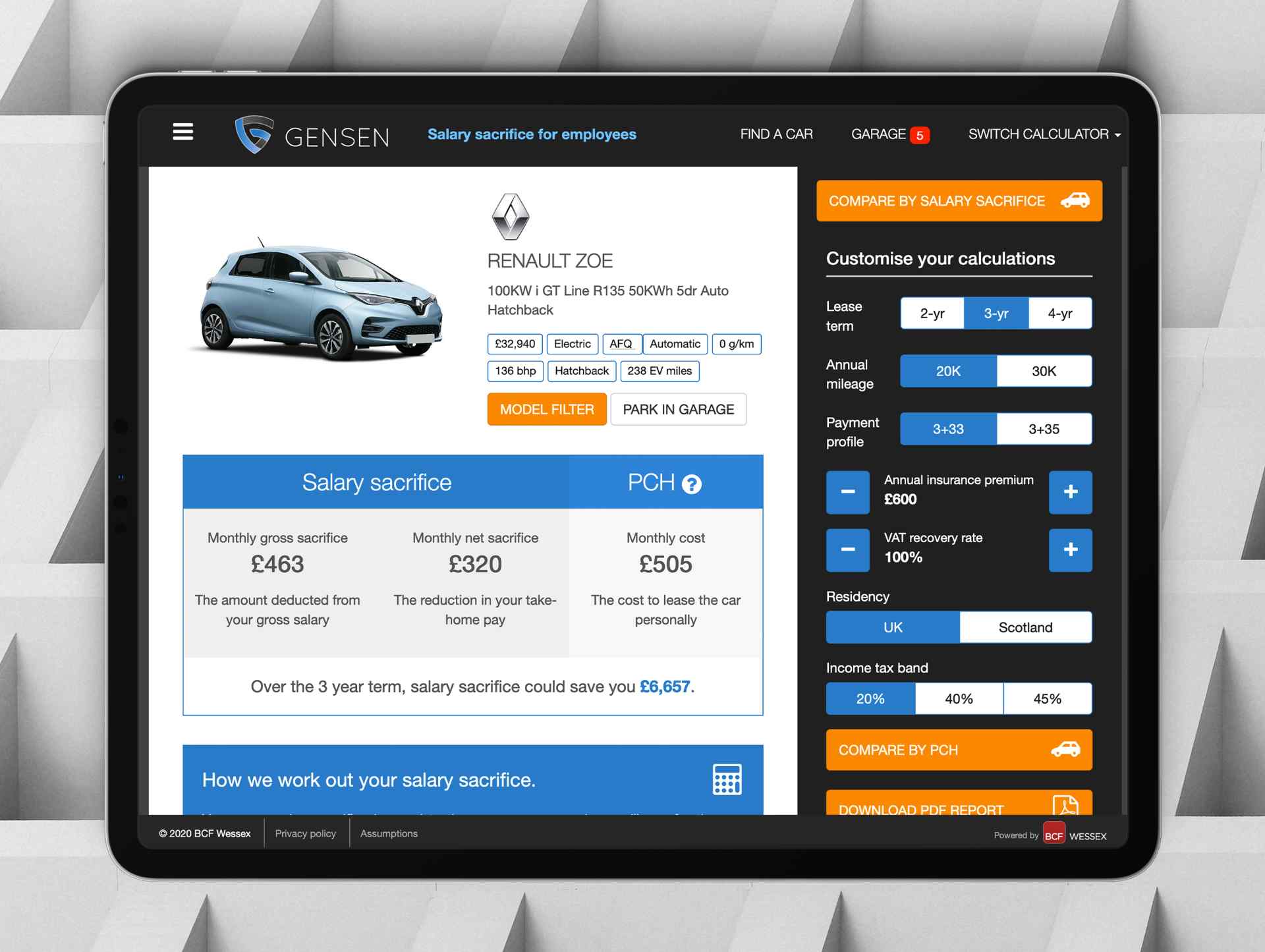

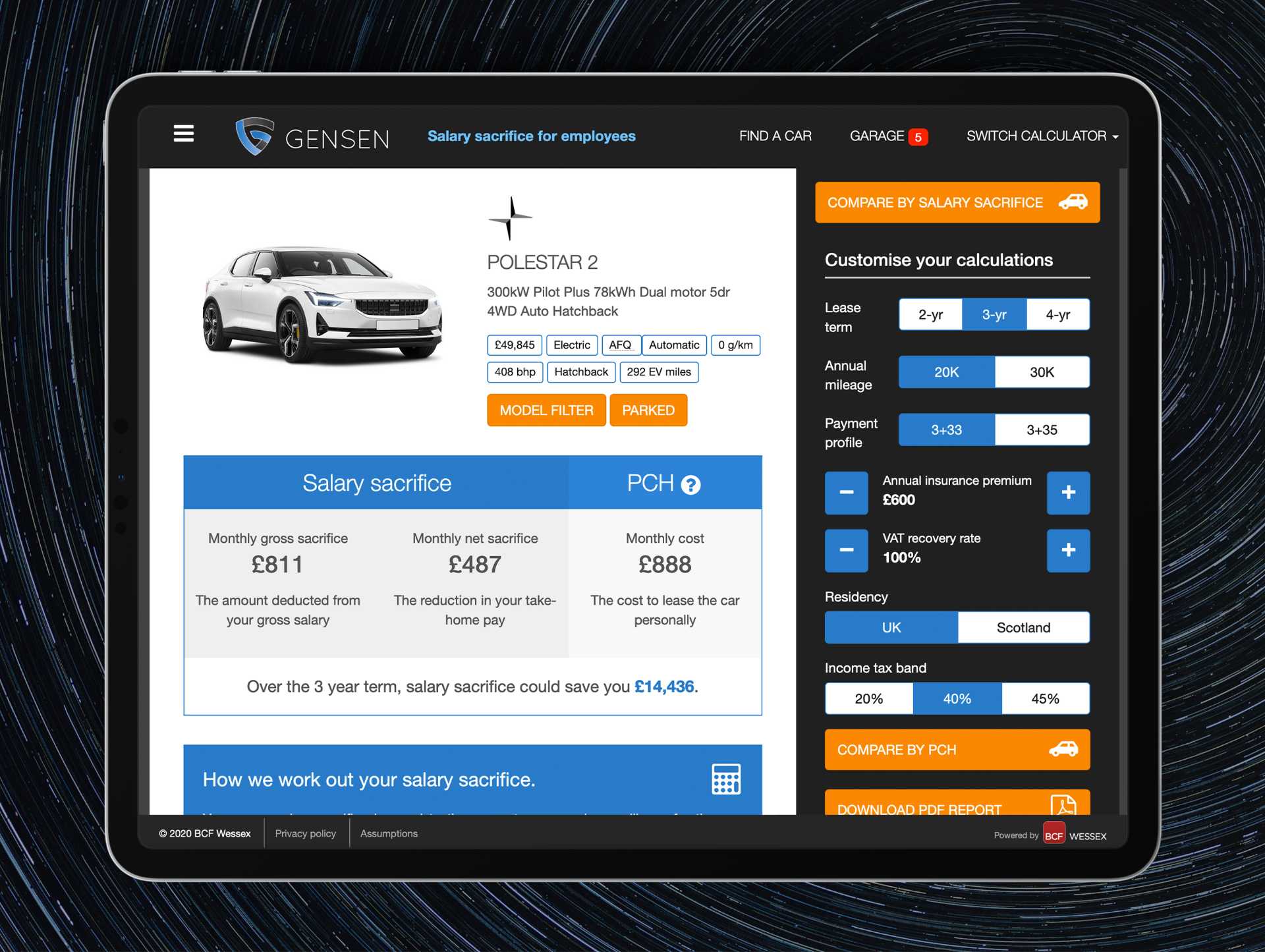

Meaning this tax break could make salary sacrifice an effectively perfect perk for drivers who want electric cars. You pay for the car using your gross pay and your income tax is based on your remaining salary and the BIK value. Salary sacrifice car what is it.

Company car schemes have recently become a hot topic among employee benefits professionals. So instead of paying an estimated 1819700 in taxes Ben will be paying approximately 1563145 instead. Prior to 6 April 2017 drivers who participated in a salary sacrifice scheme to take a company car were taxed on the Benefit in Kind BiK value of their car and depending on the choice of vehicle were able to make income tax savings by paying for the car out of their gross salary.

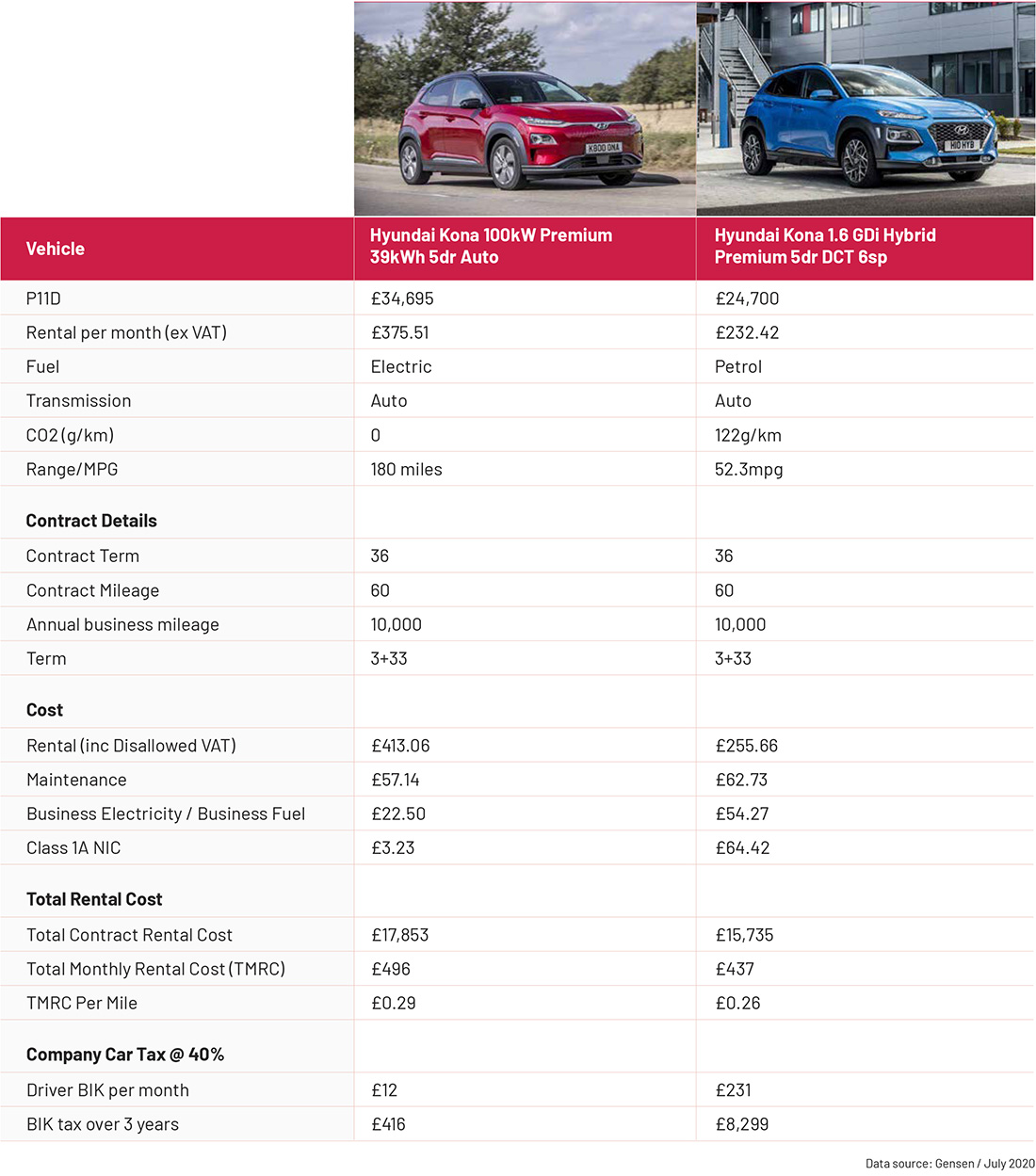

The very low company car tax on low-emission cars has made car purchases funded through salary sacrifice much more appealing. Unlike company car schemes where the company pays for the car in salary sacrifice arrangements you pay for the car and it is your responsibility. The cost of the pre-tax vehicle ute he leases and car running costs are 789313 per annum.

In this arrangement a company leases the car on behalf of the employee. Not only can you get a new car but there is no deposit to pay and all the main running costs including road tax insurance breakdown cover servicing and maintenance are included in. The cost of the car is deducted from your salary each month before you are taxed.

Salary sacrifice with Octopus Electric Vehicles is an all-inclusive low admin scheme that offers your employees and your business the benefits of 100 electric vehicles. The rate will rise to just 1 in 2021-22 and 2 in 2022-23. Company Car Taxation Bands for EVs Next Steps towards an EV with Salary Sacrifice.

In essence all of the hassle organisation and effort that comes with buying a car and then ensuring it remains roadworthy is a taken from you and is dealt with by your employer. So my understanding is as follows. Your company rents the car from a supplier such as LeasePlan and you rent it from your employer.

A salary sacrifice car is a company car. Salary sacrifice makes most sense for zero emission electric cars because company car users choosing such a vehicle are taxed at the very lowest rates - as we can see in the table below - and fall outside OpRA regulations. Starting with the basics car salary sacrifice schemes mean you exchange some of your pre-tax salary for the benefit of a car instead.

Cost of the car is 75785 this includes a discount on list price and has an official CO2 figure of 69gkm. Salary sacrifice car is a cost-neutral option for companies who want to offer their employees a car. The reduced company car tax on low-emission cars has suddenly made salary sacrifice attractive for both employers and employees.

Choosing ultra-low emission cars also provides a whole host of financial savings both for both your people and your business. When salary sacrifice car schemes were introduced the savings often outweighed the company car tax incurred making it a very cheap way for employees to drive a new car. Most of the benefits that can often come with a company car are included in a salary sacrifice car scheme such as road tax insurance breakdown cover servicing and maintenance.

If companies offer a salary sacrifice scheme employees can choose to sacrifice part of their salary in return for a car and all the sundries. This is because when your employees swap a portion of their salary for a new car that portion of their salary is sacrificed before tax and National Insurance is deducted. However tax laws were changed in 2017 to close this loophole and for cars at least BiK tax was introduced on the amount of money you were sacrificing.

Any lease can be purchased through salary sacrifice. Part of an employees salary is sacrificed before tax and National Insurance is taken. With a car salary sacrifice agreement this means that Bens taxable income is reduced to 7410687.

How Salary Sacrifice Can Save Smes Money Business Car Manager

Salary Sacrifice Benefits Will Change In Accountancy

Guide To Car Salary Sacrifice Scheme Parkers

Salary Sacrifice With Go Green Leasing

Businesses And Drivers Should Embrace The Company Car Fleet Alliance

Salary Sacrifice Car Scheme Zenith Intelligent Vehicle Solutions

Savings On Company Cars For Vending Employers And Employees

Free Company Car Paid For By Hmrc Evision Electric Vehicles

What Is A Salary Sacrifice Car Scheme Rac

Electricity Company Launches Salary Sacrifice Ev Car Scheme Fleet Europe

How Can You Make Salary Sacrifice Work For Your Customers Broker News

How Can You Make Salary Sacrifice Work For Your Customers Broker News

Salary Sacrifice Letstalkfleet

What Is A Salary Sacrifice Car Scheme Rac

Https Www Unison Org Uk Content Uploads 2019 06 Salary Sacrifice Pdf

How Does Salary Sacrifice Work For Employees The Car Expert

Free Company Car Paid For By Hmrc Evision Electric Vehicles

Everything You Need To Know About Salary Sacrifice Banker On Fire

Post a Comment for "Company Car Salary Sacrifice"